Table of Content

- Will I Get Any Money Back From My Taxes

- Choose Between a Standard or Itemized Deduction

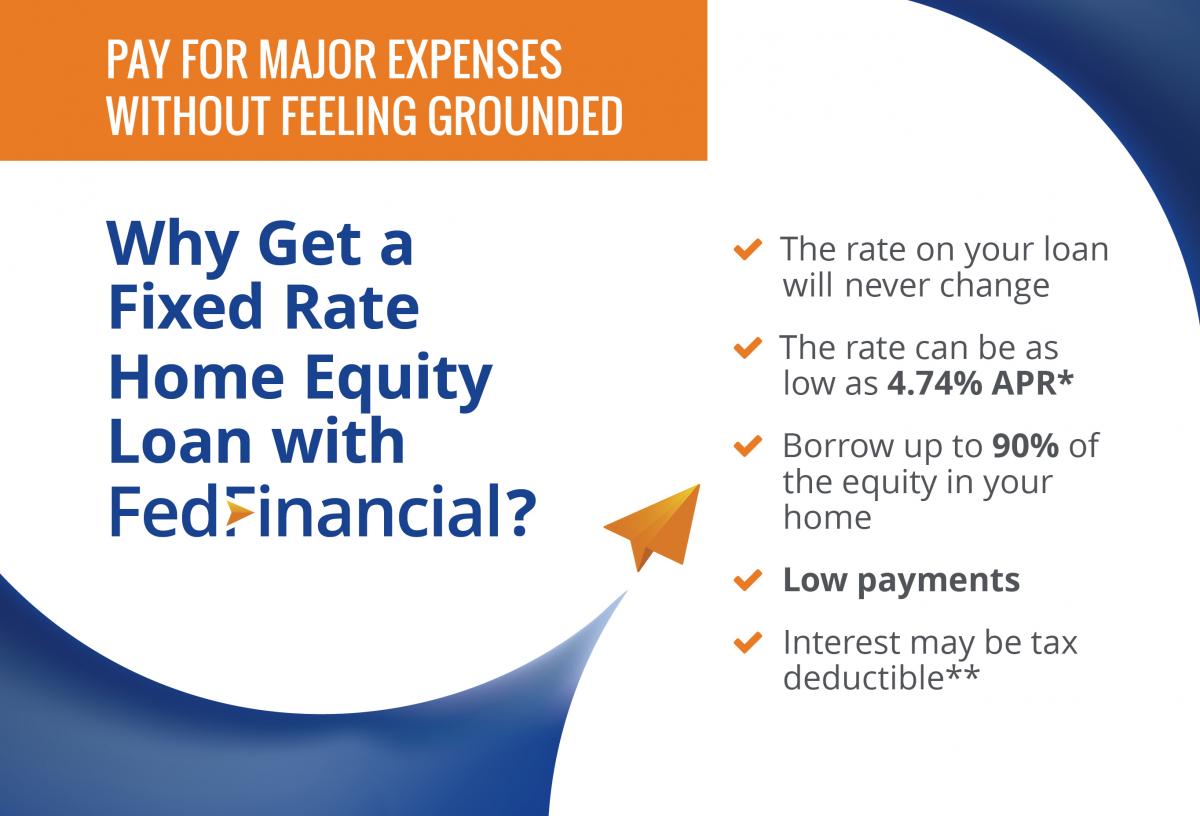

- When a home equity loan results in a tax break

- Is it Possible to Get a Tax Deduction on Your Home Equity Loan?

- Can I Deduct the Interest on My Home Equity Loan?

- Not all home equity loan interest is deductible

- Claiming a home equity loan interest deduction

First, the money must be used for home improvements or renovations. For example, you cannot take the deduction if you are using home equity proceeds to pay for personal expenditures or to consolidate credit card debt. The same goes if you are taking out a loan and letting the money sit in the bank as your emergency fund.

Whats more, you must spend the money on the property in which the equity is the source of the loan. If you meet the conditions, then interest is deductible on a loan of up to $750,000 . You can deduct the interest on up to $750,000 in home loan debts if the loans were made after Dec. 15, 2017. If your total mortgage debt is higher than that, then you wont be able to deduct all of the combined interest paid.

Will I Get Any Money Back From My Taxes

You must use this home more than 14 days or more than 10% of the number of days during the year that the home is rented at a fair rental, whichever is longer. If you don't use the home long enough, it is considered rental property and not a second home. This isn’t a secured debt unless it is recorded or otherwise perfected under state law. You can use Figure A to check whether your home mortgage interest is fully deductible.

A homeowner who does a cash-out refinance takes out a new loan for more than the balance on the original mortgage and pockets what remains after paying of the original mortgage. Home equity loans generally carry lower interest rates than other loans, such as unsecured personal loans, but may involve higher fees and other costs. And they are only available to homeowners who have enough equity in their homes to meet lenders’ loan-to-value requirements.

Choose Between a Standard or Itemized Deduction

If the Federal Reserve raises the federal funds rate, then the prime rate—and HELOC rates—can follow suit. If you need cash and have equity in your home, a home equity loan or a home equity line of credit can be an excellent solution. But the tax aspects of either option are more complicated than they used to be. Interest on a HELOC may be tax deductible—but there are conditions. To deduct your home equity loan interest, you’ll need the 1098 forms from your mortgage lender and itemized receipts to prove how you used the funds. For your loans to count, they must be on a qualifying residence, such as your primary residence , or a second home, such as a vacation home.

Of the $1,000 charged for points, you can deduct $750 in the year paid. You spread the remaining $250 over the life of the mortgage. A reverse mortgage is a loan where the lender pays you while you continue to live in your home. Depending on the plan, your reverse mortgage becomes due, with interest, when you move, sell your home, reach the end of a pre-selected loan period, or die.

When a home equity loan results in a tax break

In general, personal loans will not affect your tax return. You do not need to report loan proceeds as income, and you cannot deduct interest payments on those loans. However, the IRS makes an exception for personal loans that are secured by a residence, as is the case with mortgages, home equity loans, and HELOCs. A HELOC, or home equity line of credit, allows you to leverage the equity you’ve built in your home to get cash for home improvements or other expenses.

When you need money, you go to your lender and withdraw the amount you want. So, let's say you're single and between your various deductions, you have a total of $13,500 in write-offs for your 2021 tax return. To be clear, though, you can only claim a tax deduction for your loan's interest portion, not its principal. So if you paid $3,000 toward your home equity loan last year but only $600 of that was interest, then you're limited to a $600 tax break. The great thing about taking out a home equity loan is that you don't need to use that money for home-related expenses. You can take out a home equity loan and use its proceeds to start a business, pay off credit card debt, or even take a vacation.

For example, repainting one room probably would not be deductible. Note that the borrower should be able to connect the home equity loan proceeds to a specific improvement and keep receipts to substantiate the cost. A home equity line of credit and a home equity loan both use the equity that you have in your home as collateral.

The limits above are reduced by the amount of your grandfathered debt . However, you can treat a debt as secured by the stock to the extent that the proceeds are used to buy the stock under the allocation of interest rules. Receives at least 80% of its gross income for the year in which the mortgage interest is paid or incurred from tenant-stockholders.

Be sure to understand that these loans have advantages and some drawbacks. The lender prequalifies you to borrow up to 80% of your equity. Your home’s appraised value is $350,000, and you have a $150,000 mortgage balance.

With a home equity line of credit , you have access to money that can be drawn as needed, repaid over time, and accessed again. As a revolving line of credit, a HELOC is similar to a credit card. Qualified homes, Qualified HomeQualified loan limitAverage mortgage balance, Average Mortgage BalanceWorksheet to figure , Table 1.

No comments:

Post a Comment